Covers risks in relation to the collection of deferred payment by exporters,the account receivable by financial leasing companies and the recovery of loan principal and interest by financial institutions.The tenor is normally 2 to 15 years.

| Covered risks | Commercial risk | The debtor declares bankruptcy, winding-up and/or dissolution or the debtor's default of payment of the principal or/and interest due and payable on the due date under the loan agreement or commercial contract. |

| Political risk | The debtor is being prohibited or inhibited from repaying its debt to the Insured with the currency agreed in the loan agreement or with other freely convertible currencies as a result of the promulgation of any law, decree, order, rule or adoption of any administrative measure by the government of the debtor's country (or region) or a third country (or region) through which the repayment must be effected. | |

| The debtor being unable to implement its repayment obligations under the loan agreement as a result of any moratorium announced by the government of the debtor’s country (or region) or a third country (or region) through which the repayment must be effected. | ||

| The occurence of war, revolution or riot in the debtor's country (or region) or other applicable political events to be determined by SINOSURE. | ||

| Insured percentage | Up to 95% for export buyer's credit insurance and export deferred payment refinancing insurance. | |

| Up to 90% for export supplier's credit insurance. | ||

| Up to 90% for overseas lease insurance with financial institution (FI, including financial lease company) insured, or 90% for overseas lease insurance with non-FI insured. | ||

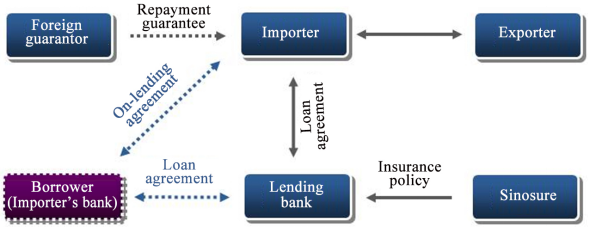

1.Export Buyer's Credit Insurance

It is an insurance product SINOSURE provides to a financial institution to safeguard its loan repayments under buyer’s credit financing.

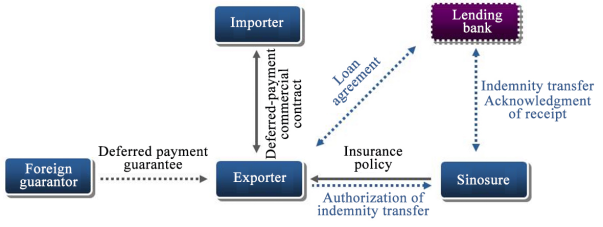

2. Export Supplier's Credit Insurance

It is an insurance product SINOSURE provides to an exporter to safeguard its foreign exchange collection under the supplier’s credit financing.

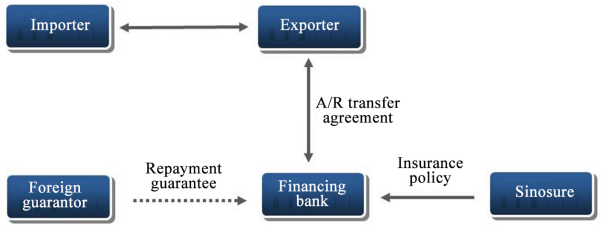

3.Export Deferred Payment Refinancing Insurance

It is an insurance product SINOSURE provides to a financial institution to safeguard its receivables, after the financial institution buys out the medium- and long-term A/R under the export contract on a non-recourse basis.